ITR: Taxpayers receive a certificate upon filing their income tax return, issued by the government, which details their annual income. This certificate serves various purposes and is beneficial in many situations. Let’s know its benefits in detail.

There is a common misconception that income tax should only be paid by individuals with high earnings, but this is not the case. It is advisable to file income tax returns regardless of whether you fall within the taxable bracket or not, as emphasized by financial advisors.

The government-issued certificate accompanying the income tax return not only discloses the individual’s annual income but also validates their status as a responsible citizen of the country. Additionally, there are numerous advantages for individuals and their families associated with filing income tax returns, including the following five major benefits:

(1). Facilitates Easy Loan Approval:

In the present era, many individuals opt for loans to purchase property, vehicles, or start a business. When applying for a loan, proof of income is typically required. While employed individuals can provide their company’s salary slip, those without employment struggle to get income proof. In such instances, presenting copies of income tax returns from the past two to three years serves as valuable documentation, simplifying the loan approval process.

(2). Easy Visa Application:

When traveling to foreign countries, obtaining a visa is a necessary step. Several developed nations, including the United States, mandate submission of income tax return copies during the visa issuance process. This requirement aids in assessing the financial standing of visa applicants. For individuals without personal income, parents’ or guardians’ income tax return copies suffice for visa applications.

(3). Assists in Accidental Death Compensation Claims:

In cases of third-party insurance, the compensation amount provided to the deceased’s family in the event of an accidental death is determined based on the deceased’s income. During legal proceedings, insurance companies request proof of the deceased’s income from the family. Providing copies of income tax returns proves invaluable in facilitating insurance claims, ensuring prompt compensation for the bereaved family.

(4). Essential for Business Ventures:

Individuals aspiring to establish businesses and secure contracts from government departments must file income tax returns. Additionally, government departments often require income tax returns from the past five years as part of the contract application process. Compliance with this requirement is essential for pursuing government contracts and initiating business ventures successfully.

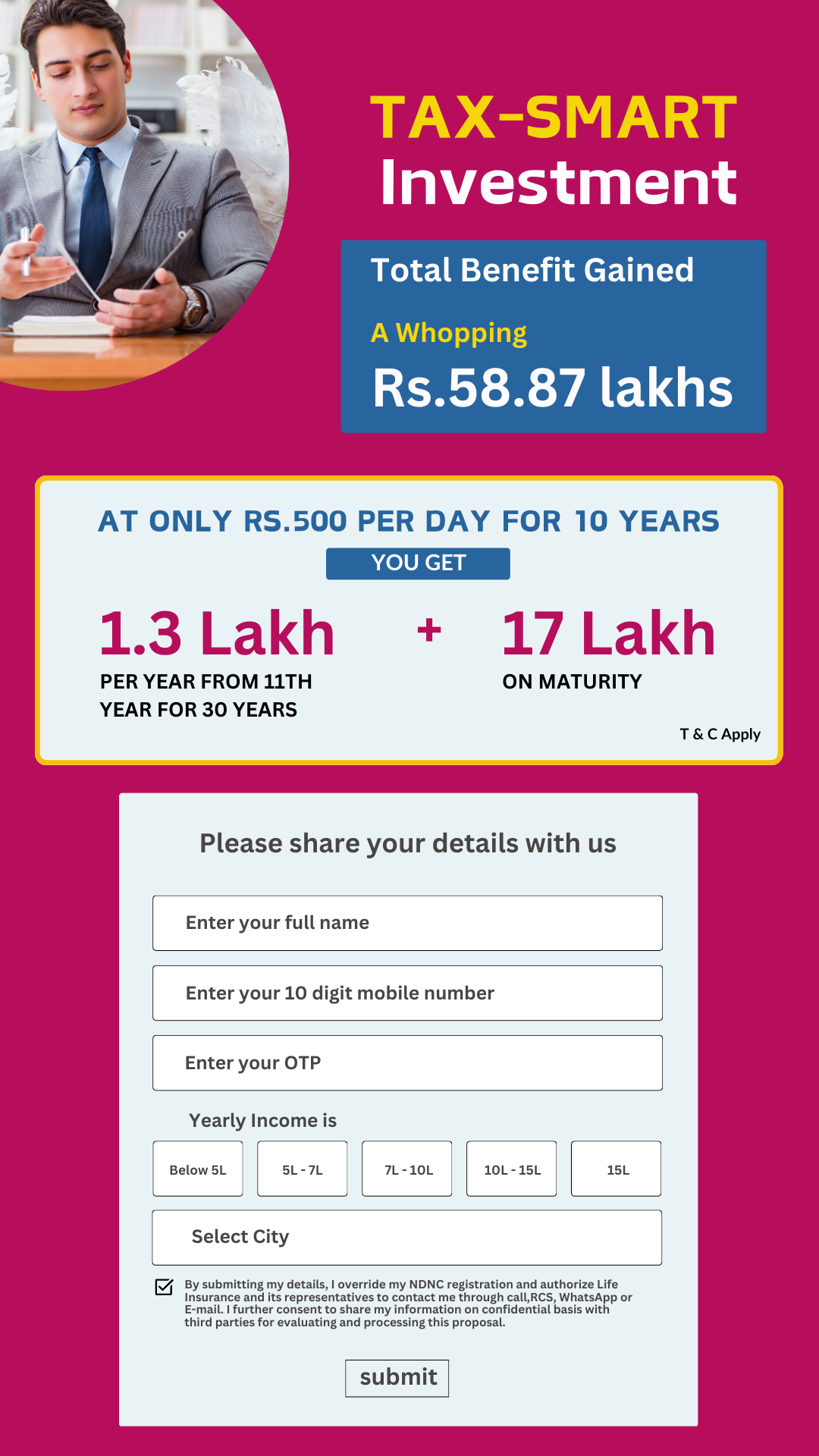

(5). Prerequisite for High-Value Insurance Policies:

Acquiring insurance policies with substantial coverage amounts, such as those exceeding Rs 50 lakh or Rs 1 crore, necessitates submission of ITR receipts. Insurance providers, particularly the Life Insurance Corporation (LIC), request income tax return documents, particularly for term policies with coverage amounts exceeding Rs 50 lakh. However, submission of income tax return receipts determines eligibility for obtaining high-value insurance policies, ensuring comprehensive coverage for policyholders.

In conclusion, the certificate received upon filing ITR offers various advantages, ranging from facilitating loan approvals to supporting visa applications and insurance claims. Its multifaceted utility underscores the importance of complying with income tax filing requirements for individuals and their families.